In this issue’s Mario on Maintenance column Mario Kuisis deals with risk management and suggests that, as we slowly return to normal business practices following several years of unpredictability, plant and industrial operators should look beyond survival and towards reducing operational uncertainty to minimum levels possible.

For many South African businesses, if not most, the main focus of the past year or two has been about survival in an uncertain economic and political environment. There has therefore necessarily been great attention devoted to cost reduction. We have discussed many examples of how proactive maintenance can make a great contribution here. However, as indications of a return to normal business strengthen, it is time to start examining some other business fundamentals that were relegated to a back seat. One of the more important of these is organisational risk management.

Whilst concentrating on assuring survival, other business risks have not gone away. If anything, many have increased. So let’s take a look at how, in particular, proactive maintenance can make a useful contribution to managing organisational risk in asset intensive organisations.

By definition, risk is the effect of uncertainty on business objectives. All organisations have a natural aversion to risk as it renders the future unpredictable and therefore more difficult to manage. Trust and confidence of all stakeholders is enhanced when the degree of uncertainty is contained to acceptable levels, at reasonable cost.

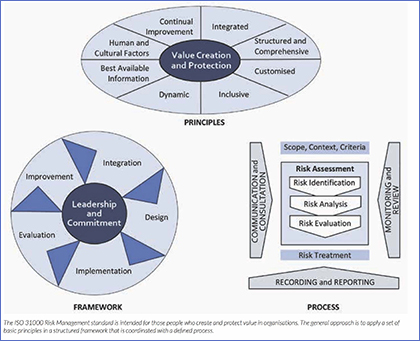

The radically revised and recently published ISO 31000 Risk Management standard sets out excellent guidelines for organisational risk management. It is intended for those people who create and protect value in organisations. The general approach is to apply a set of basic principles in a structured framework that is coordinated with a defined process. The relationship between these is detailed in the standard and illustrated diagrammatically by the figures opposite.

The radically revised and recently published ISO 31000 Risk Management standard sets out excellent guidelines for organisational risk management. It is intended for those people who create and protect value in organisations. The general approach is to apply a set of basic principles in a structured framework that is coordinated with a defined process. The relationship between these is detailed in the standard and illustrated diagrammatically by the figures opposite.

There are of course different types of risk that an organisation must consider (strategic, compliance, operational, financial, reputational, etc). There are also a host of potential origins, both external and internal and including environmental, human and cultural influences. Some examples are natural disasters, health and safety incidents associated with products or services used or supplied, influence of industrial action in and outside the organisation, security threats, raw material and utility supply interruptions, OEM support for key production equipment, adverse market trends, economic headwinds, legislative policy changes, etc. Most of these risks are not pertinent to this discussion. Our interest is wherever physical assets come into the picture, as this is where value can often be found by applying the principles of proactive maintenance.

Note we are not talking about typical operational reliability issues. Nor is it about Risk Based Maintenance (RBM). That is a perfectly valid proactive maintenance approach, but for these purposes that is considered to be a part of normal business and having an impact on the cost of doing normal business. It is not the subject of this discussion. We are dealing with matters of governance and leadership at the top level of the organisation.

Our concern here is with the materialisation of an incident, situation or event that may be in isolation, trigger a cascade or be a catalyst to others that individually or together threaten organisational objectives or sustainability or possibly even survival. The risk may be in the form of a sudden safety incident, environmental disaster or mission critical asset failure. In the case of physical assets the impact on the organisation is typically in the form of extended business interruptions affecting all or major parts of the organisation. It may also be a more insidious situation. For example, where critical assets are unknowingly deteriorating faster than projected, with consequent inadequate financial provision for timeous capital replacement.

As is evident from the principles, top management is responsible for ensuring that risk is properly and effectively managed. Read more…